san mateo county tax collector.org

Real Talk San Mateo - Update on Our Mental Health Clinician Program. Learn about this innovative program were piloting here in San Mateo.

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Monday through Friday excluding holidays.

. QuickFacts provides statistics for all states and counties and for cities and towns with a population of 5000 or more. Manage all your bills get payment due date reminders and schedule automatic payments from a single app. San Mateo County Property Records are real estate documents that contain information related to real property in San Mateo County California.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The Assessor Division compiles a roll of property tax assessments for delivery to the County Controller by July 1 each year. On Wednesday March 23 2022.

The grace period on the 2nd installment expires. The 2nd installment is due and payable on February 1. Upon successfully meeting the registration requirements the San Mateo County Tax Collectors office will assign each bidder a number to identify each bidder when purchasing tax deed properties from San Mateo County.

2 reviews of Tax Collector County of San Mateo The representatives are very courteous and knowledgeable to help surprisingly. Doxo is the simple protected way to pay your bills with a single account and accomplish your financial goals. Scott Randolph was elected Orange County Tax Collector in November 2012 and reelected in 2016.

At least before they other assessors would take your plea for reduction into consideration. The 1st installment is due and payable on November 1. We are open 830 am.

SamCERA Retirement San Mateo County Health. San Mateo County Library. Randolph represented Orange County residents in the Florida Legislature where he served as a senior member on the Finance and Tax Committee.

Of December 10th to make your payment before a 10 penalty is added to your bill. However you have until 500 pm. Currently the San Mateo County Tax Collectors office requires each bidder to place a deposit of 1500.

They issue yearly tax bills to all property owners in San Mateo County and work with the sheriffs office to foreclose on properties with delinquent taxes. Notices such as these are not authorized nor sent by the County of Santa Clara Department of Tax and Collections. Satellite locations are also available.

The Assessor Division offers a variety of online services to make information access and submission quicker and more efficient. San Mateo County Main Jail. Ad Property Taxes Info.

Treasurer Tax Collector. Online Property Taxes Information At Your Fingertips. Pay your County of San Mateo CA bill online with doxo Pay with a credit card debit card or direct from your bank account.

44 North San Joaquin Street Suite 150. The San Mateo County Public Records California links below open in a new. You can visit 555 County Center 1st Floor Redwood City CA 94063 to pay in person.

2019 2022 Grant Street Group. Call 866 220-0308 and follow the prompts. Prior to becoming the Orange County Tax Collector Mr.

650 363 - 4580. QuickFacts San Mateo County California. She will charge you a 10 if its one day late from the postal office.

The San Joaquin County Treasurer-Tax Collectors Office is located at. I dont like Sandie Arnott she is never willing to give any tax payers a break. 300 Bradford Street Redwood City CA 94063.

Redwood City Room A Clerks Office Expansion of Hours on March 7 2022 Redwood City Civil Small Claims Records Family Law and Probate will have appointment only counter hours from 830 am. Call 211 and ask for referrals to needed services in San Mateo County. The San Mateo County Tax Collector is responsible for collecting property tax from property owners.

If you have any questions please call 408-808-7900. Announcements footer toggle 2019 2022 Grant Street Group. San Mateo County secured property tax bill is payable in two installments.

Additional instructions can be found here. 555 County Center - 1st Floor Redwood City CA 94063. Please be advised any notices sent by the Department of Tax and Collections will have the County Seal and the Department of Tax and Collections contact information.

Join our San Mateo Police Department for a live update on our Mental Health Clinician Program during the next episode of Real Talk San Mateo from 6-8 pm. Perform a free San Mateo County CA public record search including arrest birth business contractor court criminal death divorce employee genealogy GIS inmate jail land marriage police property sex offender tax vital and warrant records searches. 650 363 - 4944.

The office is open until 500 pm. San Mateo County Tax Collector PO Box 45878 San Francisco CA 94145-0878.

San Mateo County Agrees To Pay Increases In New Contract With Seiu Palo Alto Daily Post

Secured Property Taxes Tax Collector

San Mateo County Fair S Opening Gate Prior To Being Renovated Into The Lit Marquee San Mateo County San Mateo California San Mateo

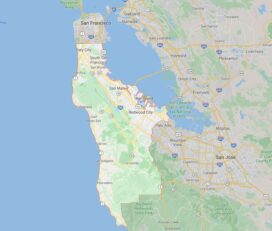

San Mateo County San Francisco Bay Area Hispanic Chamber Of Commerce Business Directory

San Mateo Hayward Bridge Metropolitan Transportation Commission

San Mateo County Parks Foundation Parks Department

La Honda Lighting Maintenance District Lafco

Connect The Coastside Planning And Building

Secured Property Taxes Tax Collector

San Mateo Marriott San Francisco Airport In San Mateo Ca Expedia

Receipt Taxsys San Mateo Treasurer Tax Collector Ebike San Mateo San

Secured Property Taxes Tax Collector

Juan Raigoza San Mateo County Controller Home Facebook

Juan Raigoza San Mateo County Controller Home Facebook

Juan Raigoza San Mateo County Controller Home Facebook

2018 Property Tax Highlights Publication Press Release Controller S Office